As the economic fallout from COVID-19 continues, more than 40 million Americans have now filed for unemployment since March. For each of the past 10 weeks, new unemployment claims have exceeded 2 million per week. We have never seen unemployment claim numbers this large. Even the Great Recession never saw jobless claims over 1 million in any week. A senior White House economic advisor predicted that the jobless rate could reach upward of 20% for May and June and stay that way into the latter part of 2020.

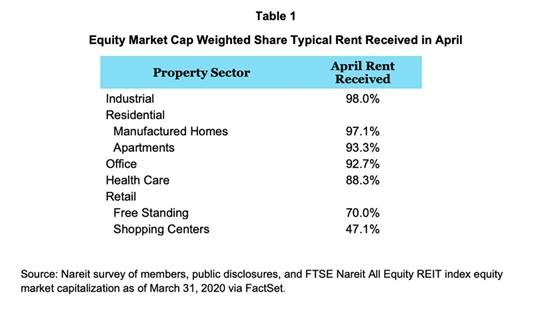

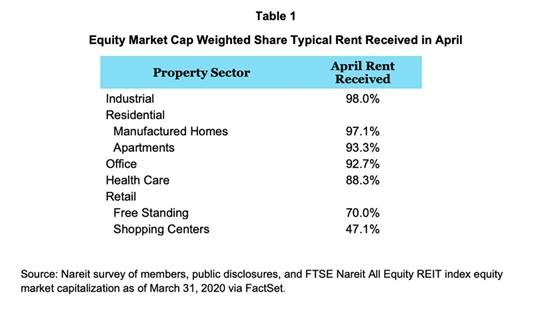

Based on these record unemployment numbers; commercial landlords have been hyper-focused on the impact this will have on rent collections. The following table shows the April rent collections from 54 publicly traded REITs surveyed by Nareit.

Industrial and multifamily lead the pack, with retail (as expected) finishing last. According to the National Multifamily Housing Council (NMHC) Rent Payment Tracker, 95.9% of residents made full or partial rent payments in April. This is based on its survey of 11.5 million professionally managed units across the country. At CALCAP, we collected 97.1% of rents in April and are currently at 95.2% for May (through 5/28). Given the current environment, we are pleased with these results. Despite that fact the eviction moratoriums are in place across the country, we believe that rent collections have remained high for four reasons:

- The willingness of landlords to work with tenants on payment plans

- Direct payments tenants received from the CARES Act

- The additional $600 per week unemployment benefit

- The general desire of residents to remain in good standing with their landlords

Going into the pandemic, the apartment industry was well positioned with occupancy rates reaching 20-year highs. Landlords are remaining cautious heading into the summer, as the re-opening of the country will dictate how quickly jobs come back. Much will depend on what type of recovery there is, and on any further government stimulus. At the end of the day, we remain cautiously optimistic as residents are continuing to show a willingness to prioritize their rental obligations.

Industrial and multifamily lead the pack, with retail (as expected) finishing last. According to the National Multifamily Housing Council (NMHC) Rent Payment Tracker, 95.9% of residents made full or partial rent payments in April. This is based on its survey of 11.5 million professionally managed units across the country. At CALCAP, we collected 97.1% of rents in April and are currently at 95.2% for May (through 5/28). Given the current environment, we are pleased with these results. Despite that fact the eviction moratoriums are in place across the country, we believe that rent collections have remained high for four reasons:

Industrial and multifamily lead the pack, with retail (as expected) finishing last. According to the National Multifamily Housing Council (NMHC) Rent Payment Tracker, 95.9% of residents made full or partial rent payments in April. This is based on its survey of 11.5 million professionally managed units across the country. At CALCAP, we collected 97.1% of rents in April and are currently at 95.2% for May (through 5/28). Given the current environment, we are pleased with these results. Despite that fact the eviction moratoriums are in place across the country, we believe that rent collections have remained high for four reasons: